What the heck is a Franchise Consultant?

Professional franchise consultants are specifically trained and become certified in building strong bridges. By Don Clayton

(more…)

Beautifying Landscapes & Lives

Border Magic – a provider of continuous concrete landscaping edging, curbing and walkways – has grown rapidly, with franchise locations throughout the country. By Rochelle Miller

Boulder Designs: An Uncomplicated Franchise System

The Boulder Designs system allows anyone to transition from a job into business ownership gradually and integrates easily into existing businesses such as landscaping businesses and general contracting businesses. By Rose Mango

Bring the Whole Family

As Ori’Zaba’s has grown, so has the size of the options they now offer families. By Elice Morgenson

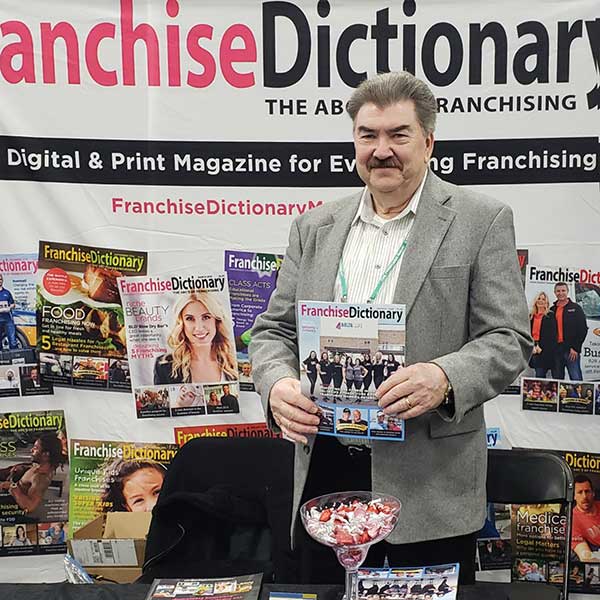

The Franchise Show

Potential franchisees turned out in droves at The Franchise Show at The Meadowlands Expo Center. By Rose Mango

Help When Disaster Strikes

Since Restoration 1 opened its first franchise in 2010, the company has expanded to more than 210 locations in 39 states in a decade. By Rochelle Miller

Women Know the Importance of “Care” in Auto Care

If you’re a woman looking for an owner-operator business, have management and sales experience, and are committed to superior customer service, Mr. Transmission/Milex just may be the right fit. By Nancy Williams

Why Your Business Should Become a “PDO”

Acronyms in the business world have become the modern entrepreneur’s second language and one leader in franchising is hoping “PDO” (Purpose-Driven Organization) will become just as universal. By Rochelle Miller

Care for Baby Boomers in Their Golden Years

The extensive number of independent and assisted-living options may be overwhelming for people trying to make a choice that’s best for them, but the consultants with Bridge to Better Living are making the process easy. By Cindy Charette